Finance Solutions in partnership with

Mitsubishi Logisnext Europe

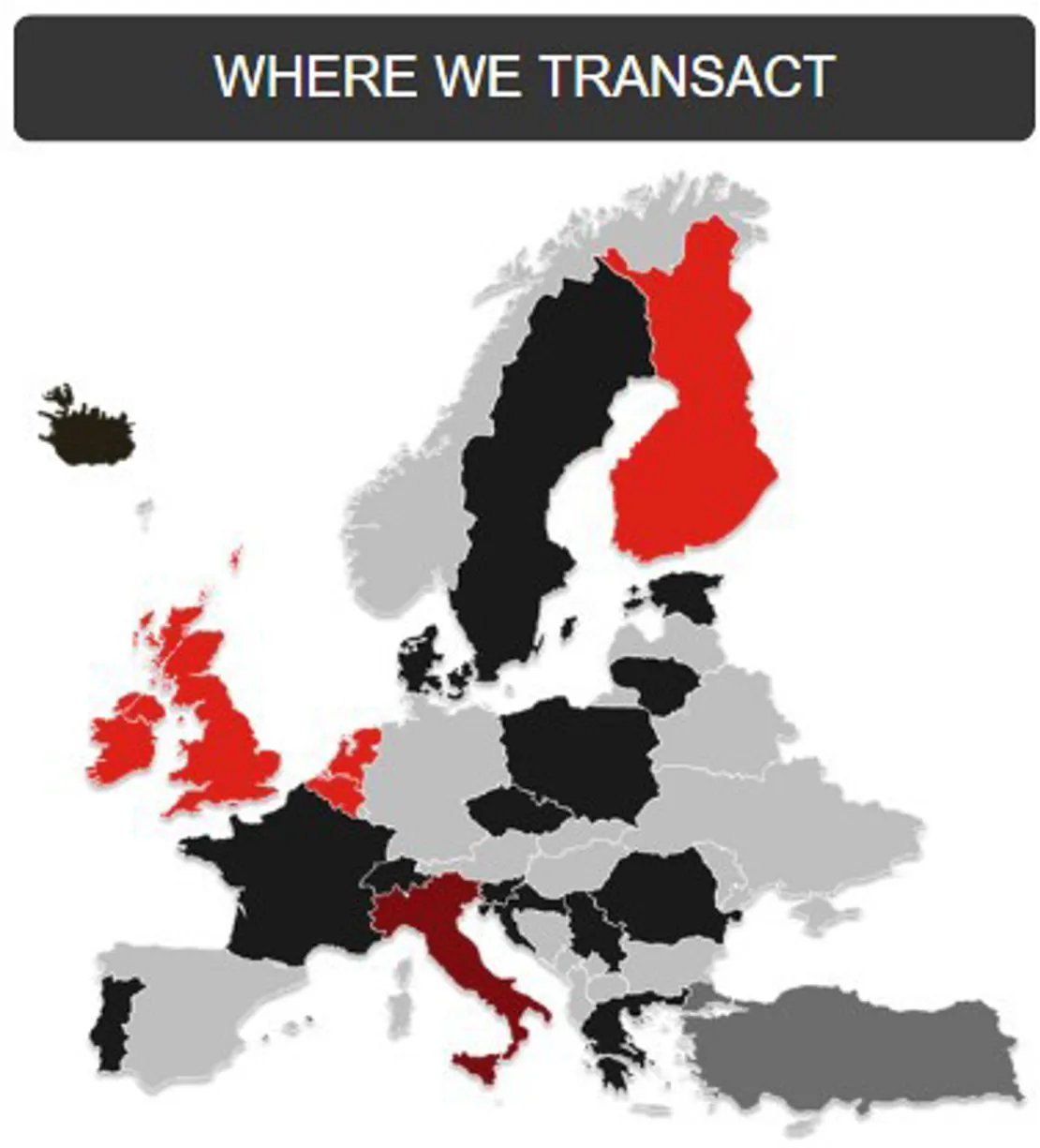

We are a dedicated channel and asset finance provider supporting Mitsubishi Group companies across Europe. Collaborating closely with MLE and its dealer network in eight European territories, we provide flexible and tailored finance solutions that align with your business.

We trade under the brands of Mitsubishi HC Capital UK in the UK and Mitsubishi HC Capital Europe in the wider market.

Our partnership-driven approach ensures innovative initiatives that not only drive sales but also elevate the customer experience. From stocking programs to end-user finance, we deliver seamless support throughout the product lifecycle:

Financial solutions to support sales

We help manufacturers, distributors, dealer networks and end-user customers better manage cash flow for the purchase of equipment for stock, demonstration purposes and rental fleet. We provide tailored finance solutions for every stage of the equipment sales cycle whether it’s forklift trucks or AGVs, for both new and used equipment to end user customers.

How we help

We recognise that maintaining equipment flow via a distribution network can have financial challenges for dealers and end users. We're here to listen to your challenges and help you find the right financial solution that aids and supports your sales strategy and route to market.

Our channel finance solutions are designed to help you sell more easily into the distribution channel or directly to your customers.

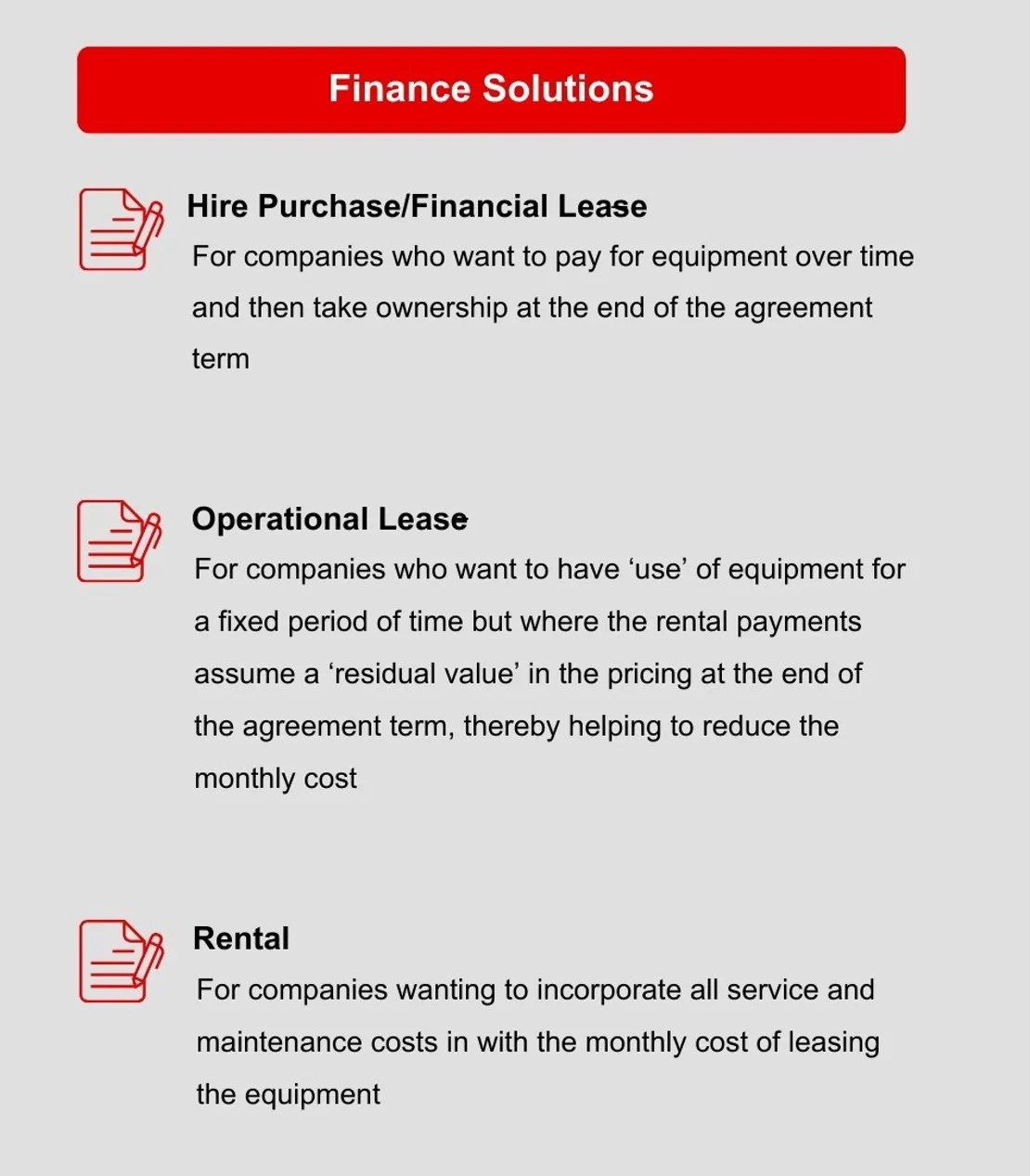

Instead of using precious working capital to purchase outright why not lease the assets with one of our finance options - you’ll have the comfort of knowing that you’ve made an investment for your business in the most cash efficient way.

Financing offers various benefits over outright purchase. By using a finance agreement, your capital outlay is reduced; leaving you have more capital to invest in other areas of your business such as stock, people, training etc. and having a regular payment plan also helps you budget and forecast your expenditure much more accurately.

Whether you are looking to introduce new or more operationally efficient equipment into your business; or if you are looking to implement a sustainability strategy that includes investment in equipment, having access to funds and being able to do so in the most cash efficient way is a key business consideration in today’s competitive market. By financing your Materials Handling equipment with us you will have quick and easy access to the funds needed to help make your next business investment more cost-efficient and affordable.

For more information please contact us:

Netherlands: Info@mhccapitaleurope.nl

ROI: Info@mhccapitaleurope.ie

Finland: Info@mhccapitaleurope.fi

Belgium: Info@mhccapitaleurope.be

More information for Customer End-user finance solutions can be found by downloading our brochures:

Finance solutions for UK End-user Customers

Finance solutions for Europe End-user Customers

Case Studies

Lima Heftruck Service

We supported Lima Heftruck Service to grow its business by servicing new customers with a flexible and competitively priced funding package combined with responsive customer service. The support and flexibility from Mitsubishi HC Capital Europe enabled Lima Hefttruck Service to acquire the right financing solution for their business to purchase machinery that it can hire out to new customers without worrying about cash flow.

Offringa

Providing 'value add' financial solutions to both dealer and customer. When Offringa B.V. needed flexibility we enabled them to take advantage of extending their payment terms. This gave them additional time to acquire and resell a large stock order of forklift trucks before paying for them. One of the trucks was sold to a end-user customer who also financed it with Mitsubishi HC Capital Europe, highlighting how it is able to provide finance solutions through the life cycle of a product.

Working with us

Our strengths lie in our ‘vendor focused’, flexible approach and our ability to provide finance solutions for every stage of the equipment sales cycle. Our approach to providing vendors with finance solutions is to be:

Flexible

![]()

Delivering products that suits your business strategy and your route to market

Proactively Positive

![]()

Always looking for the best way to transact deals with the most suitable products

Collaborative

![]()

Working with our vendor partners to help you secure more sales

Utilising our Japanese shareholder group network provides us with a strong position to serve wider group businesses with increased flexibility and speed combined with the financial strength of a global financial institution, which makes us unique. It also provides us with the size, scale, and financial power to continue to make strategic decisions which are revolutionising customer experiences and have a positive impact on our environment.

Our parent company Mitsubishi HC Capital Inc. is one of the world’s largest and most diversified financial groups, with over £60bn of assets. The corporate vision is to be one of the most trusted brands in the UK and Europe by delivering innovative solutions and providing outstanding customer experiences that achieve the best possible outcomes.

Our mission is to be the preferred finance provider of choice for our shareholder Group companies and their key accounts, Japanese owned and other vendor manufacturers.

Across all our 5 locations in UK, ROI, The Netherlands, and Finland and a transactional capability in Belgium we fund directly and have an experienced team of 50+ specialists conducting business in 25 counties by providing bespoke vendor finance solutions for specialist assets throughout the whole product lifecycle, including stocking, demonstration equipment, end user and second-hand equipment finance.

Across other European countries we fund indirectly via a network of funding partners. Contact us for further information MHC_ChannelFinance@mhccapitaleurope.nl